Solely relying on ESG data to assess a firm’s sustainability practices can introduce bias and produce an incomplete picture.

It can also miscalculate risk and misprice investments, suggests TruValue Labs, a provider of environmental-social-governance, or ESG data, sustainability metrics and real-time analytics based in San Francisco, California.

Why This MattersWhy This Matters

Cognitive biases and persistent myths weigh on the performance of conventional investing versus sustainable investing and is one major reason asset managers have not yet risen to meet client demand, says Morgan Stanley.

Different circumstances demand different analyses techniques, TruValue asserts, as it shared three where ESG-related investing works the best, across different asset classes such as stocks and bonds in its August report.

- Momentum, or positive and negative changes in ESG score, requires an ESG solution with timely data.

- Materiality, or a company’s ESG performance in the context of its financial performance, and individualized E, S, and G scores, will require granular category performance data and analyses.

- Intangibles, like comparisons between employee satisfaction and equity prices, will require tracking of the latest events and reactions by consumers. It’s not uncommon to find firms with above-average employee satisfaction and abnormal positive returns and earnings in the same firm, TruValue asserts.

This comes as ESG tools and ratings are gaining momentum and becoming more mainstream, and as board interest in sustainability reporting is rising.

What Risk?

Simplifying ESG analysis to a single score can fail to surface companies that can deliver both sustainable earnings growth and positive impact.

Heads-down analyses can protect investors from unexpected or unforeseen bankruptcies, volatility, price declines, and earnings risk.

In other words, there are no shortcuts to ESG analyses.

Read Some More

“10 studies that show how and why ESG investing works.” Thomson Reuters, July 2017.

“Pain as Green Reporting Takes Root,” CFO, June 2017.

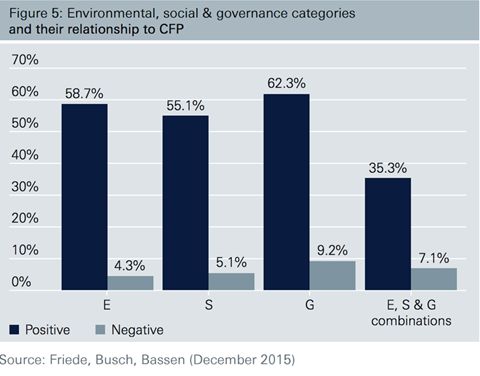

Friede, Busch, and Bassen’s study (chart above) identified positive relations for E, S, and G and corporate finance in 644 samples. According to their report, “the highest proportion is found in G with 62.3% of all cases. If the share of negative findings is deducted from positive ones, environmental studies offer the most favorable relation (58.7–4.3%). Studies with a social focus show 55.1% (5.1%) positive (negative) outcomes, hence the weakest relation.” Journal of Sustainable Finance and Investment, Taylor and Francis, December 2015.