Tag: Bias

Betting on Women – Wharton’s Project Sage

More venture capital funds are leveraging the potential of women to drive a large untapped multi-trillion-dollar market, according to Wharton Social Impact Initiative's landmark gender lens study.

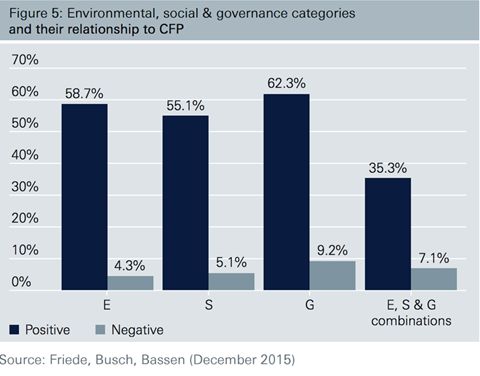

Find Powerful Relationships in ESG Data, Studies Say

Corporate financial performance is positively linked most of the time with ESG factors individually, and taken in combination. There are no shortcuts to ESG analyses, the set of studies suggests.

How Bias Can Also Impact Funding

A recent study by a researcher in Columbia suggests that bias also exists in the process of evaluating entrepreneurs, potentially impacting the funding of those entrepreneurs' ventures, and by extension, the potential opportunities of those investments.

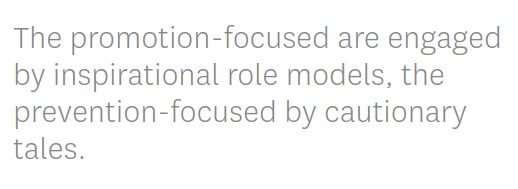

10 Arguments for Sustainable Investing for Advisors, Swiss Report

A publication by Swiss Sustainable Finance (SSF) could be used as a tool to help advisors and intermediaries prepare for discussions in sustainable investing. Use of success stories, well-cited research and better ESG data are among the suggested ways to help renew long-lasting trust.

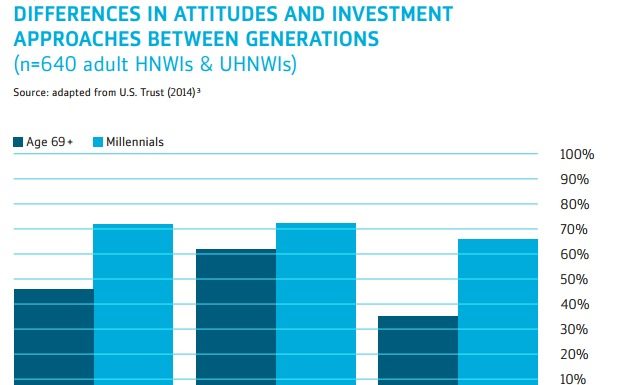

Investors Leading Advisors to ESG, Morgan Stanley Says

More investor clients are leading, and in some cases educating, their advisors during ESG investment discussions. Demographic demand, by women and younger investors, was the primary reason. And because over half of advisors, according to a Morgan Stanley survey, show "little or no interest" in ESG.

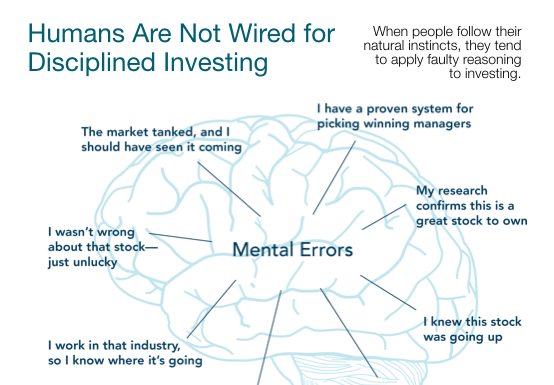

Unfounded Biases Can Get in the Way of Impact Investing

The human brain, arguably the most significant factor in any evidence-based investment strategy, is just not wired for disciplined, bias-free investing. Five persistent myths about impact investing that could be hurting you, according to Investment News.

More Women Are Leading SRI but Few are Engaging, TPI reports

Nearly 80% of women show interest in impact investing, yet only 15% actually engage in investing behavior, a fairly large gap, according to a March analysis by Mission Investors and Mission Throttle. Why the gap? Among the reasons - confidence in their literacy, attitudes to risk, structural networks that are dominated by males.