Gallup’s new report suggests that financial inclusion, or access to conventional banking services and products like loans, credit cards and savings accounts, does not necessarily lead to a greater sense of financial control or security.

Among the questions Gallup asked over 15,000 respondents between January and March 2018 were whether they felt secure enough to cover basic consumer needs (through savings or by selling assets) if they lost their income, and whether making repayments against debts does or does not make it difficult for them to pay for other things they need.

Recognizing the potential significance of context across different countries, Gallup approached respondents in 10 nations including Bangladesh, Chile, Colombia, Greece, Japan, Kenya, South Korea, United Kingdom, United States and Vietnam.

What Gallup SaidMetLife Foundation partnered with Gallup, one of the global leaders in polling and surveys, to get a deeper understanding on several points: how financially secure people are (or are not), the predictors of financial insecurity, and the degree to which people perceive that they have control over their financial lives.

To gauge financial security, the Gallup pollsters asked two simple questions: first, how long respondents could cover their basic needs (through savings or by selling assets) if they lost their income; and second, whether making repayments against debts does or does not make it difficult for them to pay for other things they need.

Financial security is a complex and contextual phenomenon: A person with the same level of income and assets might be financially secure in one country but insecure in another, depending on available social protection safety net services and a host of other variables.

So to maintain comparability Gallup carried out the survey across 10 countries – Bangladesh, Chile, Colombia, Greece, Japan, Kenya, South Korea, United Kingdom, United States and Vietnam – handpicked for their diversity.

Financial control, or the extent to which people perceive that they are in control of and can influence their financial situation, Gallup surveyed responses based on the following questions.

Dimensions of Financial Control

1. Do you think that no matter what you do, your financial situation will stay the same?*

2. Do you think that you can overcome any financial problem that you might face?

3. When you spend money on something you don’t need, do you usually regret the decision later?*

4. Have you tried to save money in the past, but been unable to do so?*

5. Do you avoid thinking about how you are going to pay for things in the future?*

6. Do you think you will EVER be able to pay back all the money you owe?

7. Do you enjoy planning what you are going to do with your money in the future?

8. Are you satisfied with how much input you have in financial decisions in your household?

9. If you had a financial emergency today, such as a medical emergency, do you think you would be able to find the money to pay for it?

10) Do you have people in your life who can help you financially if you ever need it?

*Reverse-scored item.

Finally, to derive predictors of financial insecurity, the Gallup survey cross-tabulated self-reported financial insecurity with demographic data (age, sex, education level, marital status) and with the self-reported degree of perceived financial control to see what patterns might emerge. To dig into all of these indicators (and others), see the full dataset here.

Surprising Findings

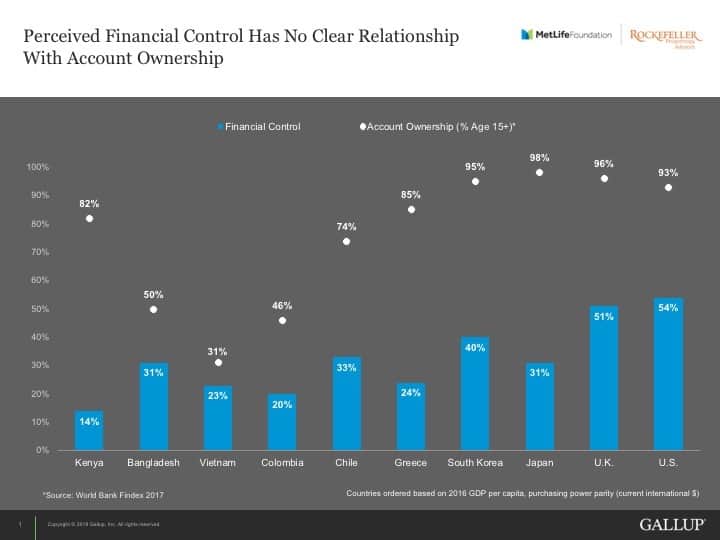

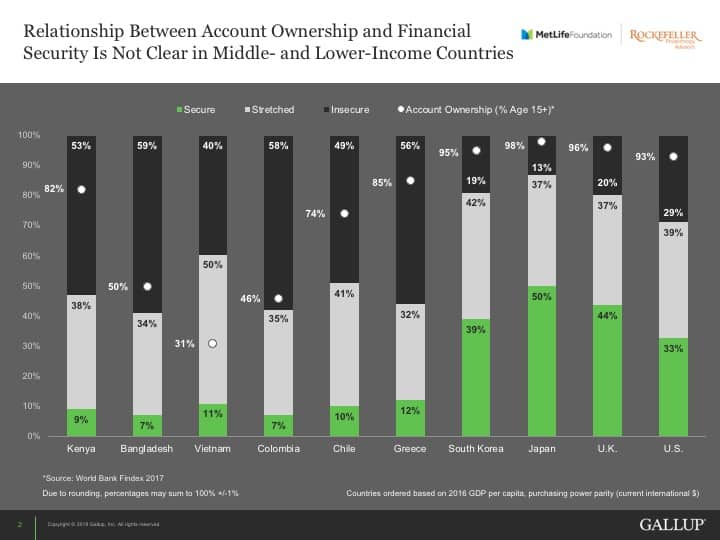

In an initial analysis full of surprises, two of the biggest were these: The relationship between account ownership and perceived financial control is weak at best. (See Figure 1). And especially in the emerging markets—places where the financial inclusion community has focused the most attention—people’s access to financial services appears to have little correlation with financial security. (See Figure 2)

In Kenya, for example, 82 percent of people have an account, but only 9 percent are financially secure. And in Bangladesh, 50 percent of people are financially included (that is, have an account), but just 7 percent are financially secure. Even in the United States, which also spends significant philanthropic and government funds to increase financial health, only 33 percent are secure despite the fact that 93 percent have an account.

Figure 1: Account Ownership and Perceived Financial Control

Figure 2: Account Ownership and Financial Security

Implications for the Financial Inclusion Agenda

So, does this mean we should give up on financial inclusion? No.

This research is a point-in-time assessment and would benefit from being repeated across a wider set of countries and over a longer period, to see how trends in account ownership and financial control and security relate.

In addition, account ownership does seem to make clients happy – in response to the survey’s question, “Overall, do you think that using the services of a bank or other financial institution improves your life?” most account owners (bank and mobile) responded positively. That might mean that they appreciate saving time by avoiding queuing to pay simple bills, or by sending or receiving money quickly to and from loved ones.

But though these benefits can be useful, they are not the ultimate goal of financial inclusion. Worse, these findings could also mean that it’s easier to borrow or spend for frivolous things or to lay bets on sports games, which would likely do little to increase feelings of control, and would certainly not boost financial security.

Further, financial inclusion has always been an overly simplistic term. Virtually all definitions of financial inclusion stress the importance of low-income people using a full suite of financial tools that enable them to manage daily cash flows, save and plan for the short and long term, take advantage of opportunities, and protect against risk. Inclusion and account ownership are just the tip of the spear and perhaps have been too much the focus in the field to date.

The balancing act in this field has always been between two related goals. On the one hand, there’s the need to identify the most efficient way to reach the largest possible number of low-income people. And on the other hand, there’s the need to make those products as useful and custom-tailored as possible, enabling clients to grow their businesses, improve their ability to send their children to school, obtain timely medical care, or otherwise respond effectively to their individual life circumstances.

Although much necessary work has been done to walk back the previous over-hyping of microcredit as a silver bullet for poverty alleviation, it seems unwise to over-correct and limit our focus to inclusion, without keeping in mind the intended outcomes. Perhaps it’s time for those of us working in this field to expand our views beyond basic financial tools and to expand or renew our focus on the quality of those tools and the outcomes they enable. Our current nomenclature is not clear or reflective of our shared goals.

What Comes Next?

MetLife Foundation requested that Gallup make the dataset publicly available. Gallup has enthusiastically encouraged researchers to use the data and share the results.

The Center for Financial Inclusion team plans to dig through these 15,000 survey responses and produce a brief later this summer, to highlight what the data says about the relationship between financial services use, attitudes toward these services, and financial health. For this deep dive, the subjective nature of the survey—which focuses on perceptions rather than empirical data—presents challenges but also an opportunity to understand the client perspective.

This data on financial control and security offers the industry one lens into financial health and wellness—in the same way an Apple Watch might provide a different behavioral nudge toward fitness than the Fitbit or Garmin.

Download the Gallup dataset here.

Sonja E. Kelly is director of research at the Center for Financial Inclusion at Accion.

Evelyn J. Stark serves as assistant vice president for Financial Inclusion for MetLife Foundation.

Photo by BRAC World via Flickr

The post Does Greater Inclusion Lead to Financial Health? New Research Raises Pointed Questions for the Industry appeared first on NextBillion.